Time2spin

The purpose of this website is solely to display information regarding the products and services available on the Crypto.com App. It is not intended to offer access to any of such products and services. time2spin You may obtain access to such products and services on the Crypto.com App.

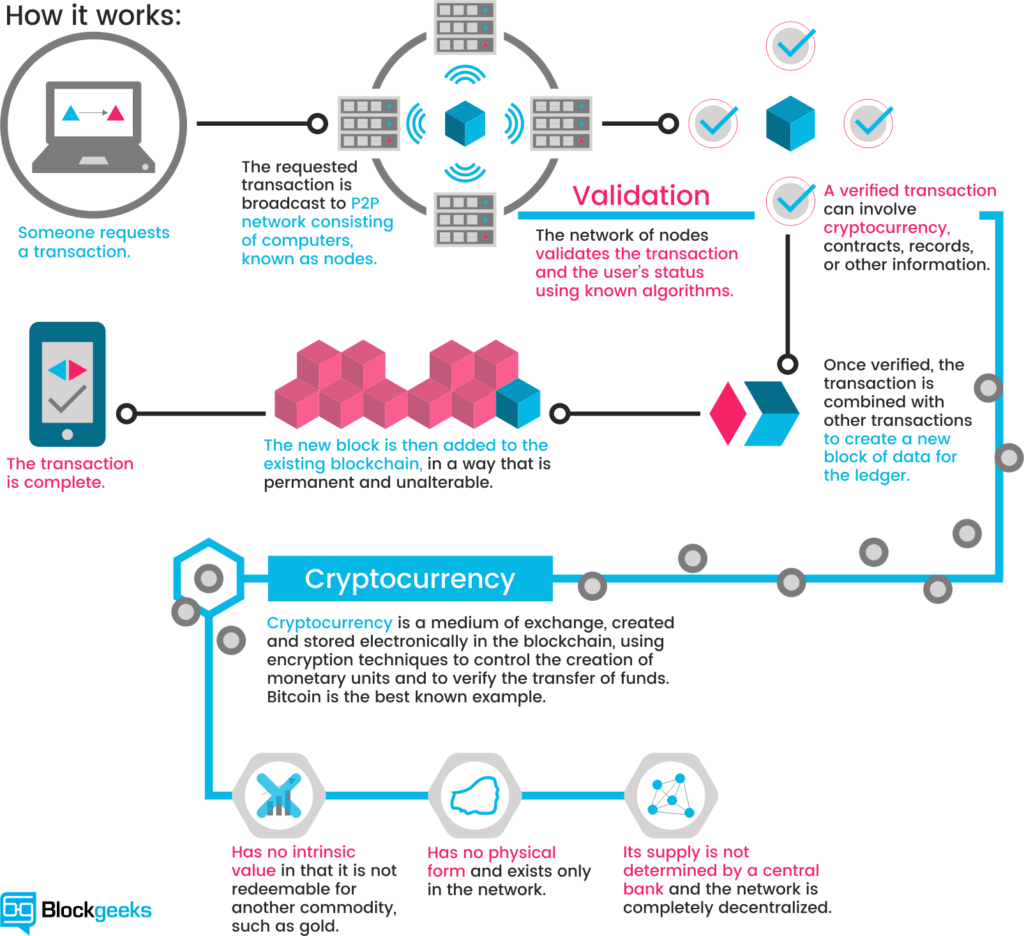

People often say that cryptocurrencies are decentralized, which is another way of saying that they are not controlled by a centralized entity. Essentially, you own your own digital wallet that gives you more freedom and control over your money.

Your goal will be to identify an asset that looks undervalued and is likely to increase in value. You would purchase this asset, then sell it when the price rises to generate a profit. Or you can try to find overvalued assets that are likely to decrease in value. Then, you could sell some of them at a high price, hoping to buy them back for a lower price.

Cryptocurrencies

There are also purely technical elements to consider. For example, technological advancement in cryptocurrencies such as bitcoin result in high up-front costs to miners in the form of specialized hardware and software. Cryptocurrency transactions are normally irreversible after a number of blocks confirm the transaction. Additionally, cryptocurrency private keys can be permanently lost from local storage due to malware, data loss or the destruction of the physical media. This precludes the cryptocurrency from being spent, resulting in its effective removal from the markets.

There are also purely technical elements to consider. For example, technological advancement in cryptocurrencies such as bitcoin result in high up-front costs to miners in the form of specialized hardware and software. Cryptocurrency transactions are normally irreversible after a number of blocks confirm the transaction. Additionally, cryptocurrency private keys can be permanently lost from local storage due to malware, data loss or the destruction of the physical media. This precludes the cryptocurrency from being spent, resulting in its effective removal from the markets.

Darknet markets present challenges in regard to legality. Cryptocurrency used in dark markets are not clearly or legally classified in almost all parts of the world. In the US, bitcoins are regarded as “virtual assets”. This type of ambiguous classification puts pressure on law enforcement agencies around the world to adapt to the shifting drug trade of dark markets.

In 2021, 17 states in the US passed laws and resolutions concerning cryptocurrency regulation. This led the Securities and Exchange Commission to start considering what steps to take. On 8 July 2021, Senator Elizabeth Warren, part of the Senate Banking Committee, wrote to the chairman of the SEC and demanded answers on cryptocurrency regulation due to the increase in cryptocurrency exchange use and the danger this posed to consumers. On 5 August 2021, the chairman, Gary Gensler, responded to Warren’s letter and called for legislation focused on “crypto trading, lending and DeFi platforms,” because of how vulnerable investors could be when they traded on crypto trading platforms without a broker. He also argued that many tokens in the crypto market may be unregistered securities without required disclosures or market oversight. Additionally, Gensler did not hold back in his criticism of stablecoins. These tokens, which are pegged to the value of fiat currencies, may allow individuals to bypass important public policy goals related to traditional banking and financial systems, such as anti-money laundering, tax compliance, and sanctions.

In the United Kingdom, as of 10 January 2021, all cryptocurrency firms, such as exchanges, advisors and professionals that have either a presence, market product or provide services within the UK market must register with the Financial Conduct Authority. Additionally, on 27 June 2021, the financial watchdog demanded that Binance, the world’s largest cryptocurrency exchange, cease all regulated activities in the UK.

Almost 74% of ransomware revenue in 2021 — over $400 million worth of cryptocurrency — went to software strains likely affiliated with Russia, where oversight is notoriously limited. However, Russians are also leaders in the benign adoption of cryptocurrencies, as the ruble is unreliable, and President Putin favours the idea of “overcoming the excessive domination of the limited number of reserve currencies.”

China cryptocurrency

Generally speaking, the Chinese government has illustrated a positive attitude towards blockchain technology. But though it will be an essential part of the future, blockchain technology is still in its early stages of development. Working in the industry feels like walking on a path where the first sunlight is about to dawn. Even though our destination is unknown, I am excited about where it could lead. Blockchain deserves an infinite and imaginative future.

Globally, central banks and regulators already have their eyes on this growing trend. Though they share a common objective — stabilizing their monetary systems and spurring innovation and economic growth — countries from China to El Salvador have already starting weighing up and implementing different regulatory options.

In the ashes of the 2008 global financial crisis, a mysterious person or group of people going by the name Satoshi Nakamoto created Bitcoin. Their aim was a more decentralized world, free from intervention by centralized institutions such as central banks. How a tool is adapted generally reflects the principle, not the tool, however – and the irony Satoshi’s original libertarian followers might have to swallow is that one of the most powerful centralized institutions in the world, PBOC (People’s Bank of China) – China’s central bank – could be adopting Bitcoin’s underlying technology, blockchain, to digitalize the RMB.

That Executive Order commits the White House to taking part in research on cryptocurrencies and to engaging departments across the government to collaborate in the creation of a regulatory framework for digital assets. It also outlines a “whole-of-government approach to addressing the risks and harnessing the potential benefits of digital assets and their underlying technology.”

Cryptocurrency exchange

First of all: Don’t use Coinbase Basic. The fees on it are exorbitant, and it just goes through the same market under the covers as the (free) Coinbase Pro. You can also swap assets between the two instantly for free at any time, so for the sake of this post I’m considering the best of both options.

BitBuy is the most established Canadian cryptocurrency exchange in Canada and offers a range of unique features that you won’t find at any of its competitors, which is why it’s on the number one spot. BitBuy offers separate features for newer and more experienced traders, making it ideal for beginners who are looking to get started with buying some crypto. They offer an excellent user interface that makes it very easy to simply buy and sell a variety of different cryptocurrencies, or if you prefer, you can dig deeper to track price movements and look at market trends. With BitBuy, you will find only the most prominent assets on offer, which you can buy via a range of payment methods in exchange for CAD including Bank Wire, Interac eTransfer and Flexpin.

Like Bitfinex, Kucoin has been around a long time, but hasn’t exactly had a stellar record, having been subject of at least one major hack/theft. On the other hand, KuCoin offers good fees, a wide variety of coin listings, and a large pile of passive income options.

I’ve seen other people saying that both Coinbase and Binance are generally ok for small amounts, and I’m reasonably new to crypto and don’t have the cash to invest loads, so maybe Coinbase or Binance would be fine for me, but every time I read another post about the issues people have had, it makes me nervous!

Additionally, you’ll be taking any passive income, security, and other considerations into your own hands with DeFi exchanges, so the only things to consider for DeFi is the trading fee, network transaction fee, and coin availability. But since there’s no lockup, fiat onramps, or anything else to consider, you can just choose whichever DeFi exchange happens to offer the coin you want at the time, and change easily between transactions.