Cryptocurrency wallet

As of February 2018 , the Chinese government has halted trading of virtual currency, banned initial coin offerings, and shut down mining. Many Chinese miners have since relocated to Canada and Texas. https://whatistheisland.com/ One company is operating data centers for mining operations at Canadian oil and gas field sites due to low gas prices. In June 2018, Hydro Quebec proposed to the provincial government to allocate 500 megawatts of power to crypto companies for mining. According to a February 2018 report from Fortune, Iceland has become a haven for cryptocurrency miners in part because of its cheap electricity.

On 19 October 2021, the first bitcoin-linked exchange-traded fund (ETF) from ProShares started trading on the NYSE under the ticker “BITO.” ProShares CEO Michael L. Sapir said the ETF would expose bitcoin to a wider range of investors without the hassle of setting up accounts with cryptocurrency providers. Ian Balina, the CEO of Token Metrics, stated that SEC approval of the ETF was a significant endorsement for the crypto industry because many regulators globally were not in favor of crypto, and retail investors were hesitant to accept crypto. This event would eventually open more opportunities for new capital and new people in this space.

The European Commission published a digital finance strategy in September 2020. This included a draft regulation on Markets in Crypto-Assets (MiCA), which aimed to provide a comprehensive regulatory framework for digital assets in the EU.

After the early innovation of bitcoin in 2008 and the early network effect gained by bitcoin, tokens, cryptocurrencies, and other digital assets that were not bitcoin became collectively known during the 2010s as alternative cryptocurrencies, or, “altcoins”. Sometimes the term “alt coins” was used, or disparagingly, “shitcoins”. Paul Vigna of The Wall Street Journal described altcoins in 2020 as “alternative versions of Bitcoin” given its role as the model protocol for cryptocurrency designers. A Polytechnic University of Catalonia thesis in 2021 used a broader description, including not only alternative versions of bitcoin but every cryptocurrency other than bitcoin. “As of early 2020, there were more than 5,000 cryptocurrencies. Altcoin is the combination of two words “alt” and “coin” and includes all alternatives to bitcoin.” : 14

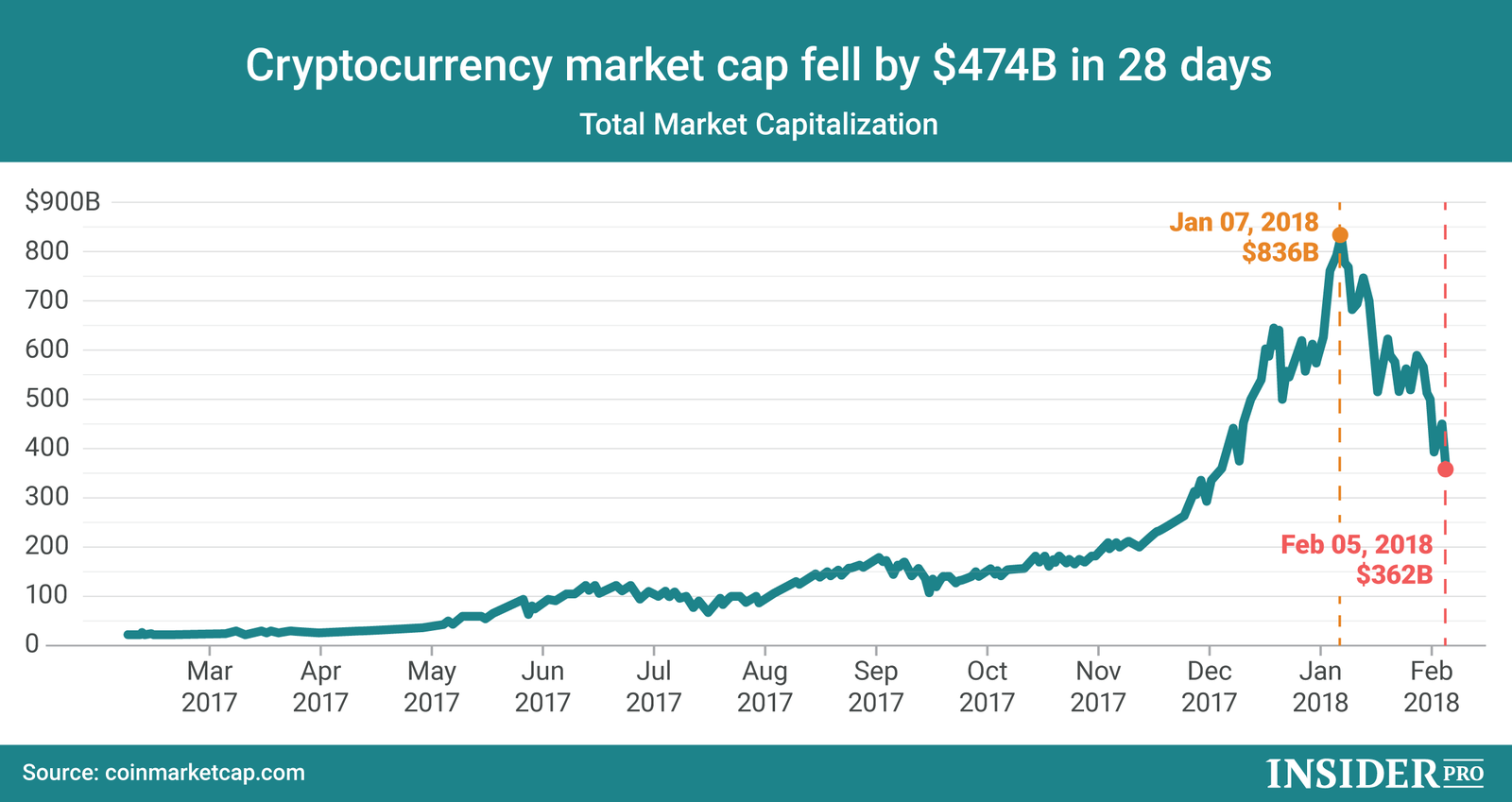

Cryptocurrency market cap

The two major changes are the introduction of the Merkelized Abstract Syntax Tree (MAST) and Schnorr Signature. MAST introduces a condition allowing the sender and recipient of a transaction to sign off on its settlement together. Schnorr Signature allows users to aggregate several signatures into one for a single transaction. This results in multi-signature transactions looking the same as regular transactions or more complex ones. By introducing this new address type, users can also save on transaction fees, as even complex transactions look like simple, single-signature ones.

The total crypto market volume over the last 24 hours is $226.6B, which makes a 24.59% decrease. The total volume in DeFi is currently $9.37B, 4.14% of the total crypto market 24-hour volume. The volume of all stable coins is now $210.31B, which is 92.81% of the total crypto market 24-hour volume.

Les données sur CoinMarketCap se mettent à jour toutes les quelques secondes, ce qui signifie qu’il est possible de vérifier la valeur de vos investissements et actifs à tout moment et de n’importe où dans le monde. Nous avons hâte de vous voir régulièrement !

The two major changes are the introduction of the Merkelized Abstract Syntax Tree (MAST) and Schnorr Signature. MAST introduces a condition allowing the sender and recipient of a transaction to sign off on its settlement together. Schnorr Signature allows users to aggregate several signatures into one for a single transaction. This results in multi-signature transactions looking the same as regular transactions or more complex ones. By introducing this new address type, users can also save on transaction fees, as even complex transactions look like simple, single-signature ones.

The total crypto market volume over the last 24 hours is $226.6B, which makes a 24.59% decrease. The total volume in DeFi is currently $9.37B, 4.14% of the total crypto market 24-hour volume. The volume of all stable coins is now $210.31B, which is 92.81% of the total crypto market 24-hour volume.

Les données sur CoinMarketCap se mettent à jour toutes les quelques secondes, ce qui signifie qu’il est possible de vérifier la valeur de vos investissements et actifs à tout moment et de n’importe où dans le monde. Nous avons hâte de vous voir régulièrement !

Cheapest cryptocurrency

The very first cryptocurrency was Bitcoin. Since it is open source, it is possible for other people to use the majority of the code, make a few changes and then launch their own separate currency. Many people have done exactly this. Some of these coins are very similar to Bitcoin, with just one or two amended features (such as Litecoin), while others are very different, with varying models of security, issuance and governance. However, they all share the same moniker — every coin issued after Bitcoin is considered to be an altcoin.

The total crypto market volume over the last 24 hours is $226.6B, which makes a 24.59% decrease. The total volume in DeFi is currently $9.37B, 4.14% of the total crypto market 24-hour volume. The volume of all stable coins is now $210.31B, which is 92.81% of the total crypto market 24-hour volume.

Top cryptocurrencies such as Bitcoin and Ethereum employ a permissionless design, in which anyone can participate in the process of establishing consensus regarding the current state of the ledger. This enables a high degree of decentralization and resiliency, making it very difficult for a single entity to arbitrarily change the history of transactions.

Xrp cryptocurrency

Cryptoinsightuk shared a similar thesis, predicting that XRP might mimic the gains of DOGE and ADA. “I honestly feel a clean break of $0.66, and we send it $1+. Probably find resistance around $1.28,” the analyst suggested.

The XRP ledger is reportedly scalable up to 1,500 transactions per second. With its Payment Channels, it can theoretically scale up to tens of thousands of transactions per second. Payment Channels are opened between transacting parties. The XRP is flagged by the blockchain so that it isn’t spent again, and the parties can send and receive payments while the channel is open. The payments are settled in bulk when the channel is closed. This allows thousands of transactions to be settled at once without tying up the blockchain’s consensus apparatus.

However, it is worth noting that most members of the RippleNet don’t use XRP tokens for transactions, but are instead using Ripple’s decentralized settlement layer and software solutions without using the network’s native digital currency.

XRP supports large-scale applications and long term projects, with 2.8B+ transactions processed representing over $1T in value moved between counterparties since 2012. XRP also offers lightning-fast, cost-effective transactions that settle every 3-5 seconds at fractions of a cent per transaction.

Despite being an extremely volatile asset, as is this case with all cryptocurrencies, XRP (XRP 15.48%) has seen significant price appreciation since its launch. It does, however, trade 84% off its 2018 record high.